Zerodha, India’s largest retail stockbroker, has become a household name among traders and investors alike. With its tech-driven platform, low-cost brokerage services, and user-friendly interface, Zerodha has transformed the trading landscape in India. Now, with buzz around the company possibly going public in the future, the question arises—are stockbroker firms like Zerodha a good long-term investment?

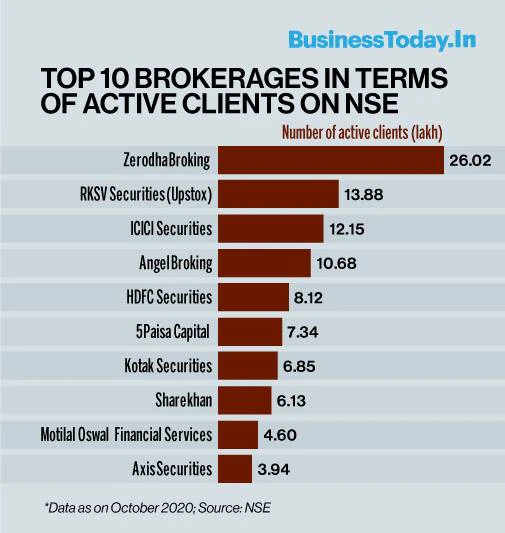

The stockbroking industry is experiencing rapid growth as more people enter the stock market, making it a sector to watch closely for long-term investments. Let’s explore why share brokers can be a solid addition to your portfolio and which publicly listed brokerage firms are already available for investment.

Why Share Brokers Are a Solid Long-Term Bet

- Growing Market Participation: With increasing financial literacy and awareness, more individuals are investing in the stock market. The surge in Demat accounts and trading volumes means brokerages are positioned to profit as more people trade and invest.

- Digital Transformation: Platforms like Zerodha have pioneered the use of technology to streamline trading, offer lower costs, and provide seamless experiences for users. The move to digital is not only increasing their client base but also cutting operational costs, making them more profitable in the long run.

- Expanding Product Offerings: Brokerage firms are no longer just about facilitating stock trades. They offer mutual fund platforms, investment advisory, insurance, bonds, and even alternate investment options, creating diverse revenue streams.

- Rise in Retail Investors: During and after the pandemic, a large number of retail investors flooded the markets. With easy access to trading apps and financial tools, this trend is likely to continue, bolstering the revenue of stockbroking companies.

List of Publicly Listed Share Brokers in India

While Zerodha is not yet listed, there are several other stockbroking firms on the Indian stock exchanges that have proven themselves as good long-term investments. Here’s a list of prominent players in the market:

- ICICI Securities (NSE: ISEC)

- Why It’s a Good Bet: ICICI Securities is a full-service brokerage with a solid parent company in ICICI Bank. It has a diversified revenue stream that includes broking, investment banking, and mutual fund distribution.

- Angel One (NSE: ANGELONE)

- Why It’s a Good Bet: Angel One, with its strong tech focus, has transitioned into a leading digital brokerage. It offers stockbroking, advisory, and wealth management services, making it attractive for long-term investors.

- Motilal Oswal Financial Services (NSE: MOTILALOFS)

- Why It’s a Good Bet: With a strong research arm and diversified financial services including asset management, Motilal Oswal has built a strong brand reputation in the financial industry.

- Geojit Financial Services (NSE: GEOJITFSL)

- Why It’s a Good Bet: Known for its large retail client base, Geojit offers a variety of investment products and services, including stockbroking, portfolio management, and wealth management services.

- 5Paisa Capital (NSE: 5PAISA)

- Why It’s a Good Bet: A low-cost discount brokerage with a tech-focused model similar to Zerodha, 5Paisa caters to budget-conscious retail investors, a rapidly growing segment.

Key Takeaways

The stockbroking industry is experiencing strong growth due to increased retail participation, technological advances, and a shift toward more investment awareness. Companies like Zerodha, if they go public, could offer significant long-term opportunities for investors. Meanwhile, publicly listed brokers such as ICICI Securities, Angel One, and Motilal Oswal Financial Services are already well-established, profitable, and have diversified business models, making them promising long-term investments.

As with any investment, it’s important to do your research, evaluate the company’s financials, and understand market trends before making a decision. Stockbroking firms, given their digital evolution and growing client base, seem well-poised for the future.