When most people think of investing, their minds immediately jump to the stock market—publicly traded companies on exchanges like the NSE or BSE in India. But there’s an exciting world beyond that, one that many retail investors haven’t explored: unlisted shares. These are shares of companies that aren’t yet listed on a stock exchange. While they may carry some additional risks, they also offer unique opportunities for those looking to diversify their portfolios and get in early on potential future market giants.

In this blog, we’ll explore:

- What unlisted shares are

- Why you should consider investing in them

- How you can buy unlisted shares

- Key risks and rewards

What Are Unlisted Shares?

Unlisted shares are equity shares of companies that are privately held and not listed on any public stock exchange. Think of startups, pre-IPO companies, and even subsidiaries of larger corporations that haven’t gone public yet.

Examples of companies that were once unlisted but are now prominent names in the market include Paytm, Zomato, and PolicyBazaar. Investing in such companies before they list can offer massive growth potential if they go public and see their valuations skyrocket.

Why Consider Buying Unlisted Shares?

There are several reasons why unlisted shares can be attractive:

1. Pre-IPO Access

You get a head start in owning shares of companies that may go public in the future. If a company performs well post-IPO, early investors stand to gain significantly.

2. Diversification

Adding unlisted shares to your portfolio can provide exposure to sectors and businesses not available in the public market. For example, companies in niche industries or innovative startups may offer growth opportunities that listed firms can’t.

3. Discounted Valuations

Since unlisted shares are often traded in the secondary market through private deals, they may be available at a discounted valuation compared to their public listing price. This gives you the opportunity to enter at a lower price and potentially sell at a premium post-listing.

How to Buy Unlisted Shares

Unlike the straightforward process of buying stocks through an online brokerage, acquiring unlisted shares requires a bit more legwork. Here’s how you can get started:

1. Through Private Equity Funds

One of the simplest ways is through private equity funds or venture capital firms. These funds invest in startups and other unlisted companies. While this option is mostly available to high-net-worth individuals (HNIs), it offers diversified exposure to unlisted companies.

2. Approach Brokers Specializing in Unlisted Shares

Many brokers and financial institutions specialize in dealing with unlisted shares. These firms have access to secondary markets where shareholders of unlisted companies (like employees or early investors) may want to offload their shares. You can approach these brokers to find available opportunities.

Some popular platforms that deal with unlisted shares include:

- Incred Money: Offers a range of unlisted shares for investment, and helps with buying and selling. Link https://www.incredmoney.com/unlisted-shares/ https://www.incredmoney.com/unlisted-shares/

- UnlistedZone: A marketplace for unlisted shares in India.

- Planify: Another platform where investors can purchase pre-IPO and unlisted shares.

3. Employee Stock Options (ESOPs)

Employees of companies that offer stock options (ESOPs) may sell these options in the secondary market. This is another way to buy unlisted shares, often at attractive valuations, since employees may look to liquidate their stock options before a public offering.

4. Through Direct Purchase from the Company

In some cases, companies may offer shares to investors directly before they go public. This can be a rare opportunity but it’s worth keeping an eye out for companies that might allow this.

Key Risks to Consider

While the potential for growth is high, unlisted shares are not without their risks. Here are a few you should keep in mind:

1. Liquidity Risk

Unlisted shares are not as easy to buy and sell as public market stocks. This illiquidity means you may have to hold onto your investment for longer periods, or may struggle to find a buyer when you want to sell.

2. Regulatory Risks

Unlisted shares are not as heavily regulated as listed shares. There’s less transparency, and you may not have access to as much information about the company’s financial health or performance.

3. Valuation Risk

Unlike listed stocks, which are valued based on market prices, unlisted shares often have uncertain or inflated valuations. This makes it harder to assess whether you’re paying a fair price for the shares.

4. High Volatility

Unlisted companies can be more volatile due to their early-stage nature or startup business models, leading to greater risk of loss.

Be sure to conduct due diligence before investing, as unlisted shares carry higher risks.

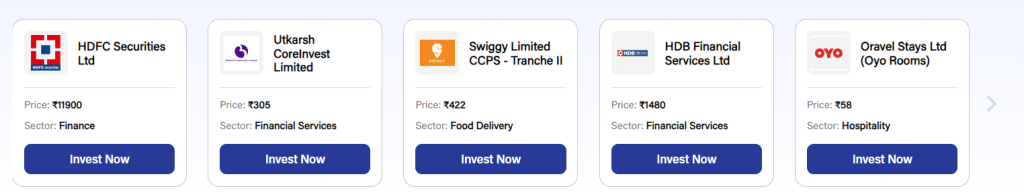

Snippet from Incred platform for few of the options