Zerodha right platform!

If you’re on the path to Financial Independence, Retire Early (FIRE), one of the key decisions is choosing the right broker for your investments. With a surge in retail investors over the past few years, Zerodha has emerged as the go-to platform for millions in India. Known for its user-friendly interface, low-cost structure, and wide range of services, Zerodha can be a solid choice for anyone in the FIRE community.

In this post, we’ll explore why Zerodha could be a great fit for your financial journey, covering its benefits, fee structure, and key features.

Why Zerodha?

Zerodha has transformed the landscape of retail investing in India. Here’s why it’s a standout platform for FIRE enthusiasts:

- Low-Cost Structure

One of the key principles of the FIRE movement is keeping costs low, and Zerodha is known for its low brokerage fees. It offers:

- Equity Delivery: Zero brokerage fees on equity delivery, which means long-term investors (common in the FIRE movement) can invest without worrying about high transaction costs.

- Intraday and F&O: Zerodha charges a flat fee of ₹20 per trade, making it one of the cheapest options for traders in India.

- Mutual Funds: Zerodha allows direct mutual fund investments via Coin, where you can invest without commission or hidden charges.

- User-Friendly Interface

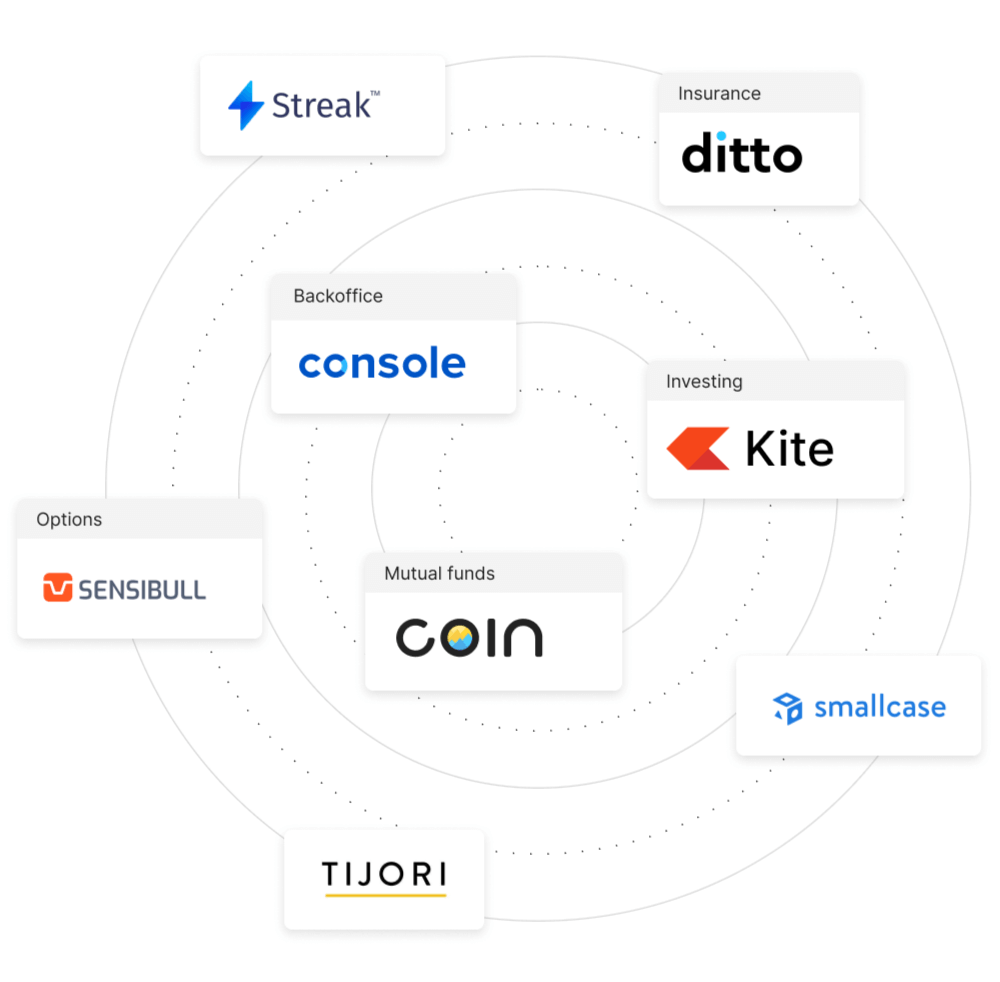

Zerodha’s Kite platform is sleek, intuitive, and easy to use. Whether you’re a beginner or an experienced trader, the interface is designed to give you a seamless trading experience with real-time updates and advanced charting features. Additionally, the Zerodha mobile app allows you to track and trade on the go. - Access to Multiple Investment Options

Zerodha offers a wide array of investment avenues, including:

- Stocks

- Bonds

- Commodities

- Currency

- Mutual Funds (via Coin)

- Initial Public Offerings (IPOs)

Having access to diverse investment options helps diversify your portfolio, a key strategy for anyone looking to achieve financial independence.

- Educational Resources

Zerodha doesn’t just stop at providing a platform—it empowers its users with educational resources. The Varsity platform offers free, comprehensive modules on stock markets, trading strategies, and personal finance. This is particularly beneficial for those in the FIRE community who are focused on growing their financial literacy. - Fractional Investments in Mutual Funds

Through Zerodha Coin, you can start investing in mutual funds with as little as ₹100, allowing for flexibility in building your investment portfolio. This enables investors, particularly those who are just starting their FIRE journey, to allocate small amounts and grow wealth over time. - SIP Option for Stocks

Zerodha offers Systematic Investment Plans (SIPs) for stocks as well as mutual funds, enabling investors to take a disciplined, long-term approach to wealth building. SIPs help smooth out market volatility, making them a good tool for long-term wealth accumulation—a core strategy in FIRE.

Zerodha’s Fee Structure: What You Need to Know

Zerodha’s fee structure is one of the reasons why it’s popular among retail investors. Here’s a breakdown of its charges:

- Equity Delivery:

- Brokerage: ₹0

(This is a huge advantage for long-term investors as there is no cost for holding stocks.)

- Intraday Trading:

- Brokerage: ₹20 or 0.03% per executed order (whichever is lower)

- Futures & Options:

- Brokerage: ₹20 or 0.03% per executed order (whichever is lower)

- Currency & Commodity:

- Brokerage: ₹20 or 0.03% per executed order (whichever is lower)

- Mutual Funds (Zerodha Coin):

- Investment Charges: ₹0 (for direct mutual funds)

- Annual Maintenance: ₹0 up to ₹25,000 in mutual fund holdings; ₹50/month beyond that

- Account Maintenance Fees (AMC):

- ₹300 per year for a Demat account

- Other Fees:

- Call & Trade: ₹50 per order

- Pledge Demat Shares: ₹30 per pledge

Why the Zerodha Fee Structure Works for FIRE Enthusiasts

The FIRE community is all about minimizing unnecessary costs to maximize savings and investment returns. Zerodha’s transparent and low-cost fee structure aligns perfectly with this philosophy. By offering zero brokerage on equity delivery and low fees for other transactions, Zerodha allows you to invest more of your money into your portfolio and less into fees.

Key Features That Make Zerodha Attractive for FIRE Investors

- Direct Mutual Fund Investments:

Using Zerodha Coin, you can invest directly in mutual funds, which ensures that you save on hidden commissions that could erode your returns over time. - Tax Reporting and Analytics:

Zerodha provides detailed tax reports and profit/loss statements, making it easier for investors to track their investments and stay tax-compliant. - Margin Trading Facility (MTF):

For those who wish to leverage their equity holdings, Zerodha provides a margin trading facility, allowing you to borrow against your holdings at competitive rates. - Zero Debt, Zero Liability:

Zerodha operates with a zero-debt model, ensuring the company’s financial stability and reliability—a crucial factor for long-term investors.

Conclusion

For anyone in the FIRE movement, keeping costs low and investments streamlined is essential. Zerodha’s low-cost structure, range of investment options, and user-friendly platforms make it an ideal choice for long-term, cost-conscious investors. Whether you’re a stock market enthusiast or someone looking to grow wealth through mutual funds, Zerodha’s tools and services can help you stay on track to achieve financial independence and retire early.

Are you using Zerodha for your FIRE journey? Share your experience in the comments below!