In today’s dynamic financial landscape, bonds have emerged as a reliable asset for investors seeking stability and predictable returns. If you’re part of the FIRE (Financial Independence, Retire Early) movement or simply exploring ways to diversify your portfolio, bonds offer an attractive option for income generation and capital preservation. StableMoney, a reputable platform in bond investments, simplifies the process, allowing you to confidently invest with ease and security.

Why Bonds Are a Good Investment for FIRE Aspirants

For those working toward early retirement, bonds can play an essential role in your investment strategy. Unlike equities, which can be volatile and subject to market fluctuations, bonds provide fixed returns over a specified period. This predictability can bring balance to your investment portfolio, particularly during uncertain times.

Introducing StableMoney for Bonds Investment

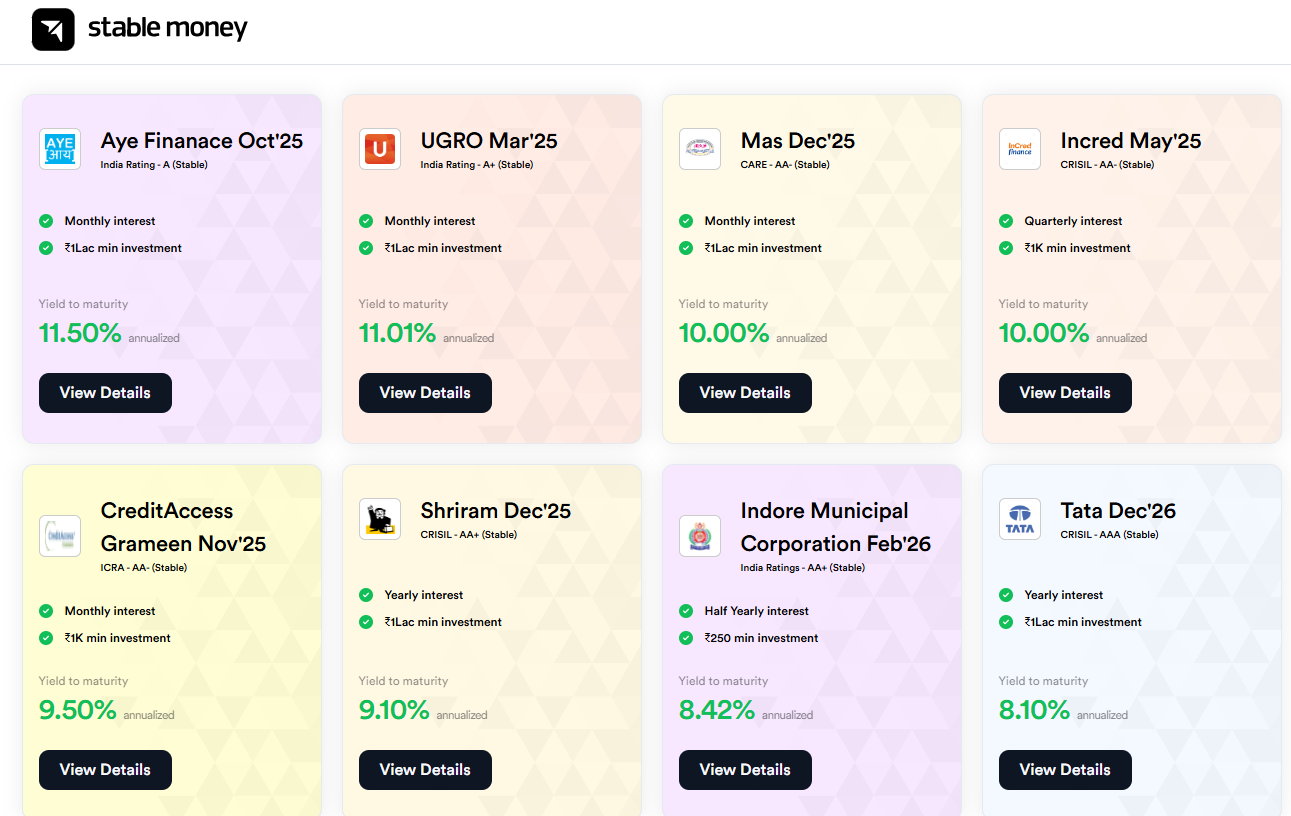

StableMoney makes the bond investment process straightforward and secure. With an easy-to-use platform, you can explore a range of bonds suited to different financial goals, whether you’re looking for short-term gains or long-term security. Their platform offers access to corporate bonds, government bonds, and other fixed-income instruments with competitive interest rates, making them a strong choice for conservative investors or those nearing retirement.

To start investing with StableMoney, you’ll need to complete a two-step verification process, ensuring both safety and regulatory compliance.

How to Get Started: Two-Step Verification Process

StableMoney prioritizes security and compliance, making it easy and safe for investors to start their bond journey. Here’s a breakdown of the two-step verification process:

1. Selfie Verification

The first step involves taking a selfie for facial recognition, ensuring that you are the person initiating the transaction. This quick step helps protect against identity fraud and enhances the security of your investment process.

2. Digital KYC via Aadhaar

Next, you’ll complete the Digital KYC (Know Your Customer) verification using your Aadhaar card. This step verifies your identity through a secure and government-approved method, providing an additional layer of security and simplifying the onboarding process. This seamless digital process allows you to complete your KYC in minutes, eliminating the need for lengthy paperwork.

With these quick steps, you’re ready to access StableMoney’s diverse range of bonds and start building a more secure financial future.

Making Informed Decisions with Bond Ratings

When investing in bonds, it’s essential to consider the creditworthiness of the issuer. Bond ratings provide insight into the issuer’s financial health and the bond’s risk level, allowing you to make more informed choices. If you’re new to bond ratings, check out our previous post on bond ratings to better understand their importance in selecting the right bonds for your portfolio.

Why Choose StableMoney for Bond Investments?

StableMoney stands out for its transparency, ease of use, and commitment to security. By offering well-researched bond options from reputable issuers, StableMoney allows investors to diversify and manage risk effectively. The platform also keeps you updated on market trends and bond performance, empowering you to make data-driven decisions.

Begin Your Bond Investment Journey with Confidence

Whether you’re new to bonds or a seasoned investor, StableMoney offers a secure and user-friendly platform to help you achieve your financial goals. With an emphasis on ease, transparency, and security, StableMoney simplifies bond investments so you can focus on building a sustainable financial future.

So, why wait? Take the first step towards steady returns with bonds on StableMoney, and watch your path to financial independence grow. For more tips on investing and achieving financial freedom, stay tuned to RetireEarly.me!

Explore your bond investment options with StableMoney and make confident financial choices for a secure future.