Tax-free bonds are an excellent investment vehicle for those looking for a steady income while enjoying tax benefits. These bonds, issued by government-backed institutions, not only provide safety but also help in diversifying your investment portfolio with fixed-income securities.

What Are Tax-Free Bonds?

Tax-free bonds are long-term debt instruments issued by government enterprises. They typically have a maturity period of 10 to 20 years. The biggest attraction is that the interest income from these bonds is exempt from income tax under Section 10(15)(iv)(h) of the Income Tax Act, 1961. This tax exemption makes them especially appealing to individuals in higher tax brackets, offering a higher effective post-tax return compared to taxable bonds.

Key Features of Tax-Free Bonds

- Tax Benefits: The interest earned is entirely tax-free, reducing the overall tax liability.

- Safety: Issued by government entities, these bonds carry minimal credit risk.

- Fixed Returns: They provide a stable income stream with predetermined interest rates.

- Liquidity: These bonds can be traded in the secondary market, though they are less liquid than equities.

- Long Tenure: With maturities ranging from 10 to 20 years, they offer long-term stability.

Who Should Invest?

Tax-free bonds are suitable for:

- High net-worth individuals (HNIs) looking to minimize their tax liabilities.

- Retirees in need of a stable income stream.

- Conservative investors seeking capital protection and steady returns over high-risk investments.

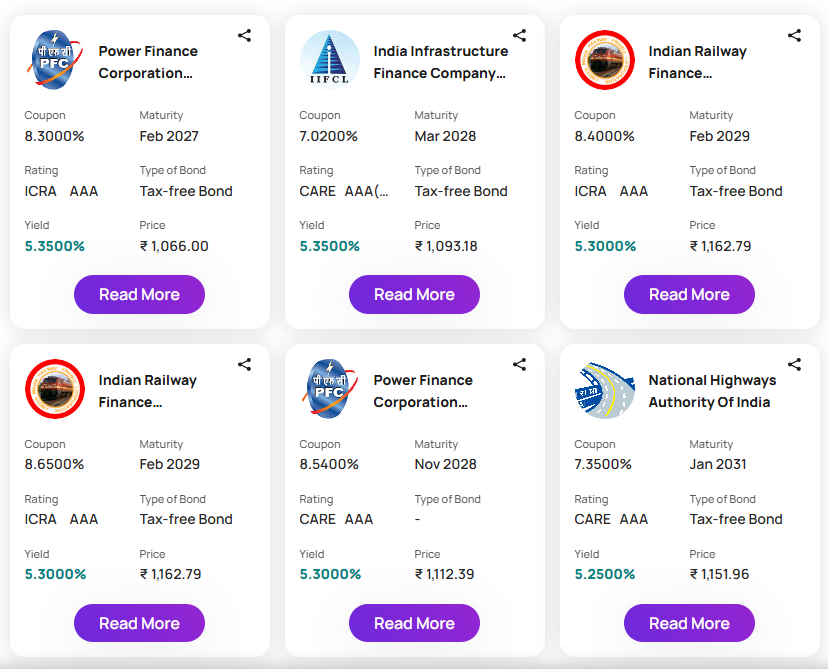

List of Popular Tax-Free Bonds in India with Interest Rates

Below is a list of some popular tax-free bonds available for investment in India, along with their indicative interest rates:

- National Highways Authority of India (NHAI)

- Interest Rate: 7.35% – 7.50%

- Purpose: Financing national highway projects.

- Indian Railway Finance Corporation (IRFC)

- Interest Rate: 7.25% – 7.40%

- Purpose: Infrastructure development in the railway sector.

- Power Finance Corporation (PFC)

- Interest Rate: 7.20% – 7.35%

- Purpose: Funding power sector projects.

- Housing and Urban Development Corporation (HUDCO)

- Interest Rate: 7.30% – 7.45%

- Purpose: Supporting housing and urban infrastructure development.

- Rural Electrification Corporation (REC)

- Interest Rate: 7.25% – 7.40%

- Purpose: Financing rural electrification projects.

- Indian Renewable Energy Development Agency (IREDA)

- Interest Rate: 7.15% – 7.30%

- Purpose: Supporting renewable energy projects.

Benefits of Investing in Tax-Free Bonds

- Tax Efficiency: These bonds provide significant tax savings, especially for individuals in higher tax brackets.

- Stable Returns: They offer a reliable income source over the bond’s tenure.

- Low Risk: Backed by government entities, they come with high credit ratings and minimal default risk.

- Portfolio Diversification: Adding these bonds to your portfolio helps balance the risk from equity investments.

Where to Invest in Tax-Free Bonds?

One of the best platforms to explore and invest in tax-free bonds is IndiaBonds. IndiaBonds offers a comprehensive selection of tax-free bonds, providing detailed insights, real-time data, and an easy-to-use interface for investors. Whether you are a seasoned investor or just starting, IndiaBonds simplifies the process, helping you make informed investment decisions. Other platforms also include ICICIDirect.com. Please evaluate before investing.

Conclusion

Tax-free bonds are an ideal choice for investors looking for a safe and tax-efficient income stream. While the returns might not be as high as those from equity investments, the stability and tax advantages they offer make them a valuable addition to any investment portfolio. Whether you’re planning for retirement or seeking a steady income source, tax-free bonds can help you achieve your financial goals.

Outbound Links: