Introduction to SIP and SWP: Your Path to Financial Freedom

Achieving financial independence and retiring early (FIRE) is a dream for many, and it requires a well-structured approach to savings and investments. For those on this journey, Systematic Investment Plans (SIP) and Systematic Withdrawal Plans (SWP) can play a crucial role. These tools not only help you build a robust retirement corpus but also enable you to sustain it effectively during your retirement years.

In this post, we’ll break down the basics of SIP and SWP, their benefits, and how they can be integrated into a FIRE plan to maximize your returns while ensuring financial security.

What is a Systematic Investment Plan (SIP)?

A Systematic Investment Plan (SIP) is a method of investing in mutual funds at regular intervals. SIPs allow you to invest a fixed sum of money in a chosen mutual fund, typically monthly, which helps in accumulating wealth over time.

Benefits of SIP

- Rupee Cost Averaging: With SIP, you invest consistently over time, which helps average out market volatility. You buy more units when prices are low and fewer when prices are high, optimizing the cost.

- Power of Compounding: SIPs allow your money to grow and compound over time, which is especially beneficial if you start early.

- Budget-Friendly: SIPs are highly flexible, letting you start with small amounts, which can be increased as your income grows.

By investing through SIP, you instill financial discipline and steadily build a retirement corpus, making it easier to meet your early retirement goals.

What is a Systematic Withdrawal Plan (SWP)?

A Systematic Withdrawal Plan (SWP) is a mechanism that allows you to withdraw a fixed amount from your mutual fund investments at regular intervals, typically monthly. SWPs are ideal for retirees or those seeking regular income from their investments.

Benefits of SWP

- Steady Income Stream: SWP provides a consistent cash flow, making it easier to manage expenses during retirement.

- Capital Preservation: By carefully managing withdrawal amounts, you can maintain your investment’s growth potential.

- Tax Efficiency: Compared to withdrawing a lump sum, SWP can be tax-efficient, as only the gains are subject to taxation (depending on the country’s tax laws).

With SWP, you maintain control over your retirement corpus, ensuring that you have a steady income stream while preserving the principal amount for as long as possible.

SIP vs. SWP: Key Differences and How They Work Together

| Feature | SIP | SWP |

|---|---|---|

| Purpose | Build wealth | Generate regular income |

| Investment Type | Regular investment in mutual funds | Periodic withdrawal from investment |

| Ideal for | Growing retirement corpus | Maintaining cash flow during retirement |

| Tax Impact | Tax on gains, depending on the holding period | Tax on capital gains, depending on holding period |

Using SIP and SWP Together for Financial Independence

For those aiming to retire early, integrating both SIP and SWP into your financial strategy is a smart move. Here’s a step-by-step approach to use them together:

- Accumulate Wealth with SIP: Start by investing in a diversified set of equity or hybrid funds through SIPs. Consistent investments over 10-15 years can yield substantial returns, compounding your wealth.

- Switch to SWP for Steady Income: Once you’ve accumulated a sufficient corpus, shift from SIP to SWP. This way, you can begin drawing a steady income from your investments to cover your living expenses during retirement.

- Adjust Withdrawals Periodically: To ensure your funds last, regularly evaluate and adjust your SWP amount based on market conditions and inflation.

By combining SIP and SWP, you create a self-sustaining investment cycle: SIP builds wealth, and SWP helps you utilize that wealth for regular income.

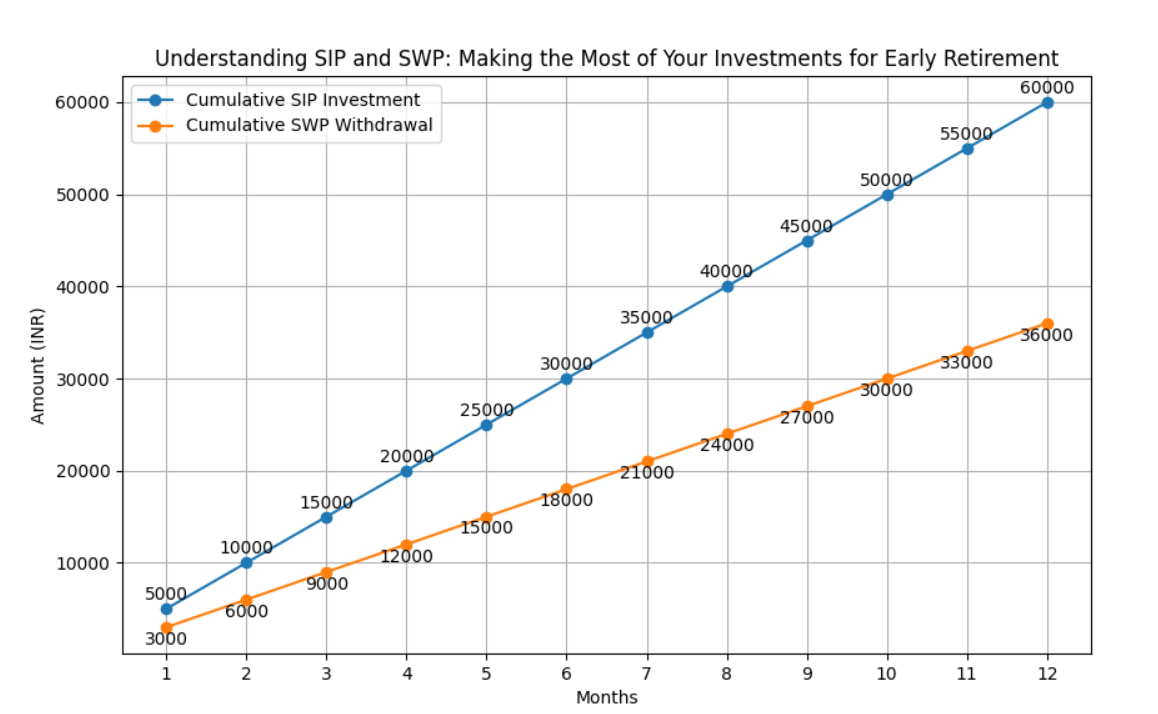

Real-Life Example: SIP and SWP in Action

Consider Ramesh, who starts investing in mutual funds through SIP at age 30 with ₹10,000 per month. By the time he reaches 50, his investments have compounded significantly, creating a sizable retirement corpus. At this stage, he switches to an SWP, withdrawing ₹20,000 monthly to cover his expenses. The remaining corpus continues to grow, even as he enjoys financial independence.

Factors to Consider Before Starting SIP and SWP

- Risk Tolerance: Understand your risk appetite, as equity-based SIPs can be volatile, and SWP withdrawals might be affected by market fluctuations.

- Tax Implications: SIP and SWP gains are subject to capital gains tax. Be aware of your country’s tax rules to maximize post-tax returns.

- Investment Horizon: Start SIPs early for longer compounding benefits, and consider SWPs when you’re ready to transition from accumulation to withdrawal mode.

Conclusion: SIP and SWP as Tools for Early Retirement

Both SIP and SWP offer a structured way to grow and manage your investments, helping you work towards financial independence. SIPs provide the discipline and growth needed during the wealth accumulation phase, while SWPs offer stability and income in your retirement years. Together, these tools make a powerful combination for anyone on the path to retiring early.

By making consistent, well-planned investments and smart withdrawals, you can achieve financial independence without compromising your lifestyle.

Ready to start your journey to early retirement? Let us know how SIP and SWP fit into your FIRE plan!