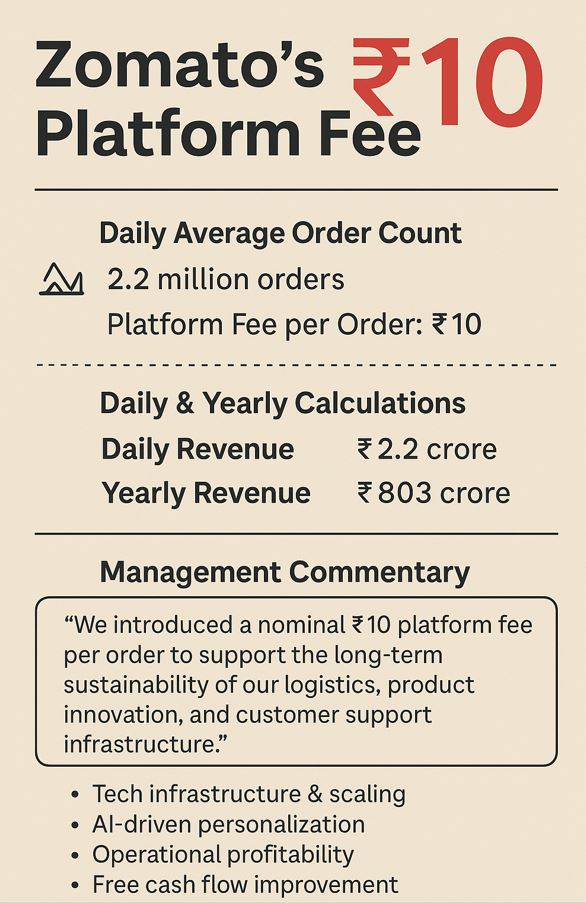

India’s food tech giant, Zomato, recently introduced a ₹10 platform fee per order for all users, including Zomato Gold members. While this change might seem marginal to customers, it holds significant financial implications for Zomato’s topline. Let’s break down the math behind this decision, explore its yearly impact, and decode the management’s potential thinking behind it.

📊 Daily Average Order Count: The Engine Behind the Fee

As per Zomato’s latest earnings report, the platform clocks 2.2 million orders daily across India.

📌 Daily Orders: ~2.2 million (22 Lakh)

📌 Platform Fee per Order: ₹10

💰 Daily & Yearly Revenue Potential

Daily Revenue from Platform Fee

= 2,200,000 orders × ₹10

= ₹22,000,000 (₹2.2 crore per day)

Annualized Revenue Potential

= ₹2.2 crore × 365 days

= ₹803 crore annually

That’s ₹800+ crore in annual recurring revenue—purely from a small platform fee.

📈 How This Translates for Zomato

This ₹10 fee is not directly tied to food costs, delivery charges, or restaurant commissions. It likely goes straight to the platform’s coffers, contributing to:

- Tech infrastructure & scaling

- AI-driven personalization

- Operational profitability

- Free cash flow improvement

💬 Management Commentary: A Hypothetical View

While Zomato hasn’t publicly given a detailed breakdown of this move, here’s what a management commentary could look like:

“We introduced a nominal ₹10 platform fee per order to support the long-term sustainability of our logistics, product innovation, and customer support infrastructure. With growing order volumes and consistent user demand, this fee helps us invest further into AI, delivery optimization, and platform reliability without compromising merchant margins or consumer experience.”

🔍 Final Thoughts: Small Fee, Big Impact

Zomato’s ₹10 fee might have raised eyebrows, especially among loyal customers used to free deliveries under Zomato Gold. However, when analyzed from a business standpoint, it’s a masterstroke. Minimal customer churn, high order volumes, and a relatively inelastic ₹10 fee contribute to significant bottom-line impact with minimal overhead increase.

₹800+ crore in annual revenue from a single line item?

That’s a solid case study in scaling via microtransactions.

🔗 Further Reading

Tags: Zomato, Platform Fee, Indian Startups, Food Delivery, Revenue Model, Financial Analysis, Business Strategy, Fintech