Mutual funds are one of the most trusted investment tools for retail investors looking to grow their wealth systematically. But did you know that how you invest in mutual funds can make a huge difference in your long-term returns? The choice between Regular Plans and Direct Plans is crucial. And if you’re someone who believes in smart, cost-effective investing, Zerodha Coin offers one of the most seamless platforms to invest in Direct Mutual Fund Plans—completely commission-free.

Let’s explore what Direct Plans are, why Zerodha Coin is a great platform to consider, and how you can get started in just a few clicks.

What is a Direct Plan in Mutual Funds?

Mutual funds are available in two variants—Regular Plans and Direct Plans. While the underlying portfolio is the same, the key difference lies in the expense ratio.

- Regular Plans are sold through intermediaries like brokers or distributors, who receive a commission from the Asset Management Company (AMC).

- Direct Plans, on the other hand, are purchased directly from the AMC, which means there’s no commission involved—resulting in higher returns over the long term.

For example, over a 20-year horizon, the difference between a Regular Plan and a Direct Plan could mean several lakhs in corpus—just because of lower annual charges.

Why Choose Zerodha Coin?

Zerodha Coin is a web and mobile-based platform offered by India’s leading discount broker, Zerodha. It allows users to invest in direct mutual fund plans across 40+ AMCs with zero commission and no lock-in. Here’s why it’s a favorite among DIY investors:

- No Commission: All investments are in Direct Plans—no trail or hidden charges.

- Unified Portfolio View: Track mutual funds, stocks, and bonds under one dashboard.

- Instant Redemption & Orders: Simple and fast transaction interface.

- Seamless Integration: Uses funds from your Zerodha trading account; no need for separate bank transfers.

- No DP Charges: Mutual funds are held in demat format, but with zero depository participant charges.

You can explore Coin here: https://coin.zerodha.com

How to Get Started with Zerodha Coin

If you already have a Zerodha account, investing via Coin is as easy as logging in. For new users, here’s a step-by-step guide:

Step 1: Open a Zerodha Account

You’ll need a demat and trading account with Zerodha. The account opening process is fully digital and usually takes less than 48 hours. You can begin here: https://zerodha.com/open-account

Step 2: Log In to Coin

Visit coin.zerodha.com and log in using your Zerodha credentials. You can also download the Coin mobile app.

Step 3: Search for Mutual Funds

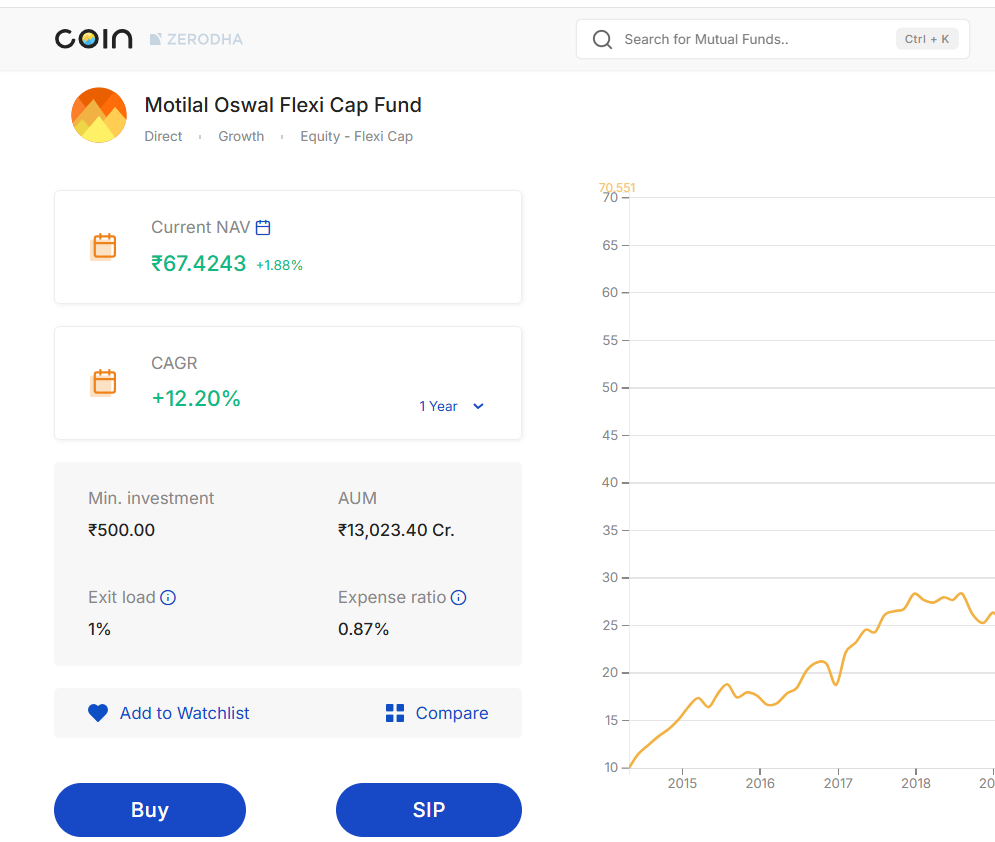

Use the search bar to browse by AMC, category (like ELSS, Large Cap, Mid Cap), or fund name. Zerodha Coin also provides filters for risk profile, return performance, and fund rating.

Step 4: Choose “Direct Plan”

All mutual funds on Coin are automatically Direct Plans, so you don’t need to worry about selecting the right one.

Step 5: Invest

You can choose to make a lump sum investment or start a Systematic Investment Plan (SIP). Payments are debited from your Zerodha trading account, making the experience smooth and fast.

Key Advantages of Using Direct Plans via Zerodha Coin

| Feature | Direct Plan via Coin | Regular Plan via Broker |

|---|---|---|

| Commission | None | Yes (up to 1%) |

| Returns | Higher | Lower due to expense ratio |

| Transparency | Full | Limited |

| Platform Fees | ₹0 | Usually free, but costs hidden in returns |

Zerodha Coin empowers you to save more, grow faster, and stay in control of your financial future. Unlike traditional brokers who earn a commission every year, Coin aligns with your success.

Is Zerodha Coin Safe?

Yes. Zerodha is one of India’s most trusted brokers and is regulated by SEBI. All mutual fund holdings via Coin are in your demat account and visible under CDSL, giving you full control and transparency.

Final Thoughts

If you’re serious about long-term wealth creation and don’t want to leave money on the table, switching to Direct Plans via Zerodha Coin is a smart move. The platform is intuitive, cost-effective, and built for investors who prefer transparency and control. In just a few minutes, you can set up your portfolio and begin your journey toward financial independence—without paying unnecessary commissions.

Tags

#ZerodhaCoin #DirectMutualFunds #InvestSmart #WealthCreation #MutualFundIndia