Introduction

In an era where data is more valuable than oil, the apps we use to manage our investments are quietly gathering far more information than we might expect—or need. A recent chart published by LiveMint and shared by Zerodha CEO Nithin Kamath has sparked serious conversations about how intrusive trading platforms have become, especially on Android devices.

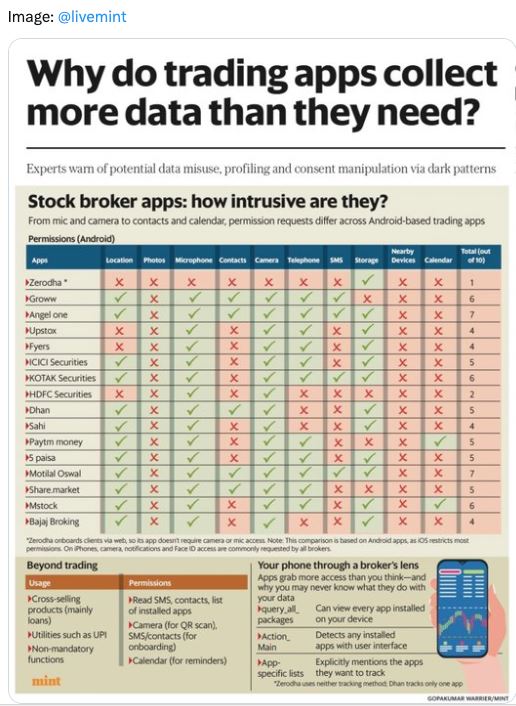

The graphic lays bare just how many permissions these trading apps request—from camera and microphone access to contacts, calendar, and even storage. In contrast, Zerodha stands out by asking for only one permission—location—and is set to remove even that in its next release.

So why are trading apps asking for this much access? And more importantly—should you be worried?

The Reality: Trading Apps Know a Lot About You

According to the analysis, most popular broker apps including Groww, Angel One, Upstox, ICICI Securities, HDFC Securities, and Paytm Money request up to 9 or 10 different permissions on Android. These include:

- Access to photos and storage

- Camera and microphone

- SMS and call logs

- Location, contacts, and calendar

These permissions raise concerns not just around security, but around profiling, behavioral manipulation, and non-transparent consent mechanisms.

The most worrying part? You might not even realize what data you’re giving away—and what it’s being used for.

Why Are These Permissions Problematic?

1. Cross-Selling and Profiling

Many of these permissions enable the apps to:

- Read your SMS, which could include sensitive financial information such as OTPs or bank alerts.

- Access your calendar and contacts, potentially allowing for profiling your social and professional network.

- Use your camera and microphone, which, if misused, can be a significant privacy violation.

This data is often used to cross-sell products, serve personalized (but intrusive) ads, or train behavioral algorithms without explicit user consent.

2. Dark Patterns and Consent Manipulation

Dark patterns refer to user interface designs that trick users into giving permissions or agreeing to terms they might not fully understand. In trading apps, this could mean:

- Making access to the app conditional on granting permissions.

- Pre-selecting consent checkboxes.

- Not clearly disclosing what data is being collected and why.

The lack of transparency damages trust—and in the case of financial apps, that trust is critical.

Zerodha’s Approach: A Privacy-First Stand

Zerodha, India’s largest brokerage platform, stands out in this report for taking a minimalist and privacy-first approach. According to Kamath, the upcoming version of the Zerodha app will not even request storage permission. The platform doesn’t use tracking metadata, and it doesn’t collect camera, contact, or microphone access.

This is a significant contrast in an industry increasingly driven by data monetization. Zerodha’s approach demonstrates that you can deliver a robust trading experience without compromising user privacy.

What Can You Do as a User?

- Audit app permissions in your Android settings and disable non-essential ones.

- Use apps that adopt privacy-by-design, such as Zerodha.

- Demand transparency from your broker—ask why they need each permission.

- Stay informed about how your data might be used for purposes beyond trading.

Final Thoughts

The trading app industry is facing a critical crossroads. As competition heats up, companies are leveraging user data not just to enhance the user experience but to drive cross-selling, profiling, and possibly even third-party monetization.

The image shared by Nithin Kamath isn’t just a privacy checklist—it’s a wake-up call. It shows that not all brokers treat your data the same. In a world where you’re the product, choosing platforms that respect your privacy might be the smartest investment you make.

Tags: #Privacy #TradingApps #Zerodha #DataSecurity #FintechIndia #Brokerage

Disclaimer

This article is for educational purposes only. It does not constitute financial or legal advice. Always consult with appropriate professionals before making financial decisions or installing trading apps.