-

The Remarkable Turnaround Story of Tanishq: A Jewel in Titan’s Crown

Tanishq, a Tata Group venture and India’s premier jewelry brand, is a shining example of a successful turnaround story. Today, Tanishq’s brand value and appeal contribute significantly to the soaring stock price of its parent company, Titan Company Ltd., on the Indian stock market. But the path to success wasn’t straightforward. From struggling to gain…

-

Bitcoin(BTC) Reaches All-Time High of $82,380: Will It Hit $100k in November 2024?

The Bitcoin (BTC) price surge has been nothing short of phenomenal this November, achieving a record all-time high of $82,380, driven by significant market catalysts. The influential backing of Elon Musk and Donald Trump’s election win are two factors that have fueled investor excitement. These developments come as Musk, with his extensive resources, withstands global…

-

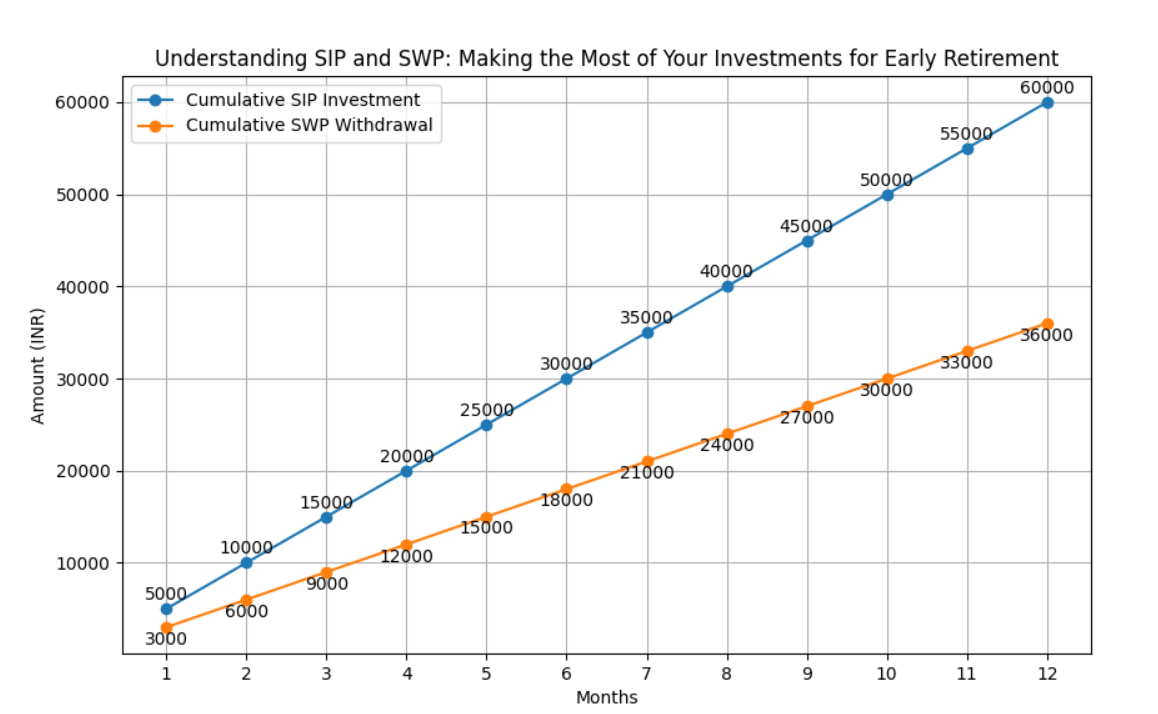

Understanding SIP and SWP: How to Make the Most of Your Investments for Early Retirement

Introduction to SIP and SWP: Your Path to Financial Freedom Achieving financial independence and retiring early (FIRE) is a dream for many, and it requires a well-structured approach to savings and investments. For those on this journey, Systematic Investment Plans (SIP) and Systematic Withdrawal Plans (SWP) can play a crucial role. These tools not only…

-

TRAI’s 160 Phone Number Series: Protecting Users from Financial Fraud

With financial fraud on the rise, protecting users from scams has become a top priority in telecommunications. The Telecom Regulatory Authority of India (TRAI) recently introduced the 160 number series initiative, a proactive approach designed to combat spam calls and protect users from fraudulent financial schemes. This blog explores how the 160 number series works,…

-

Two Paths to Wealth (or Poverty): Understanding the Slow and Sudden Journeys

Achieving financial independence is a journey, and along the way, there are choices that can either propel you towards wealth or lead you into financial hardship. Interestingly, the path to wealth (or poverty) can happen in two distinct ways: slowly or suddenly. Knowing the mechanics of these journeys can be a valuable guide, helping you…

-

Introducing IndiaBonds.Com: Your Gateway to Great Returns

Investing in bonds has always been a reliable way to secure steady returns, and with IndiaBonds, this process has become even more accessible and rewarding. IndiaBonds is a SEBI-registered and licensed Online Bond Platform Provider (OBPP) that offers a wide range of bond options with fixed returns ranging from 6% to over 13%. Let’s delve…

-

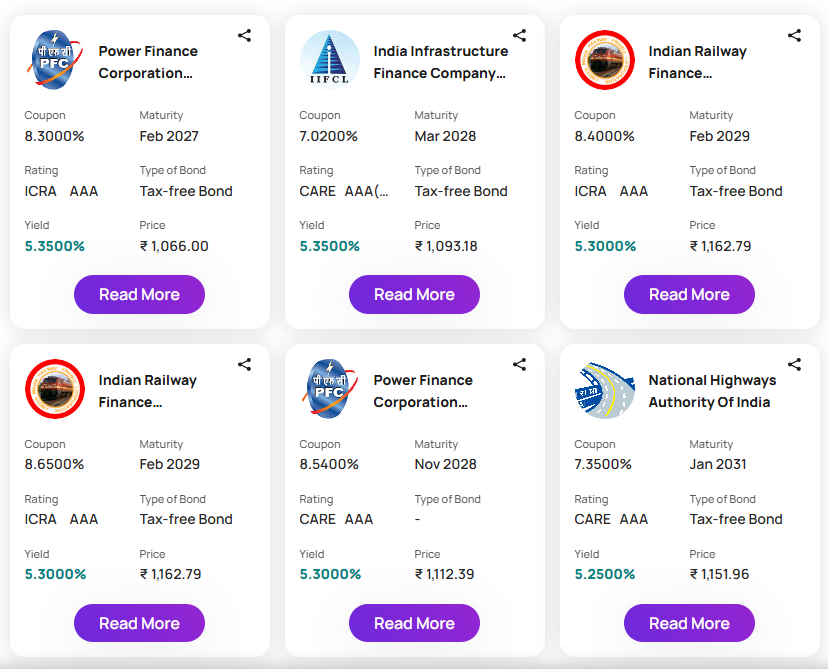

Tax-Free Bonds: A Safe Haven for Your Investments

Tax-free bonds are an excellent investment vehicle for those looking for a steady income while enjoying tax benefits. These bonds, issued by government-backed institutions, not only provide safety but also help in diversifying your investment portfolio with fixed-income securities.

-

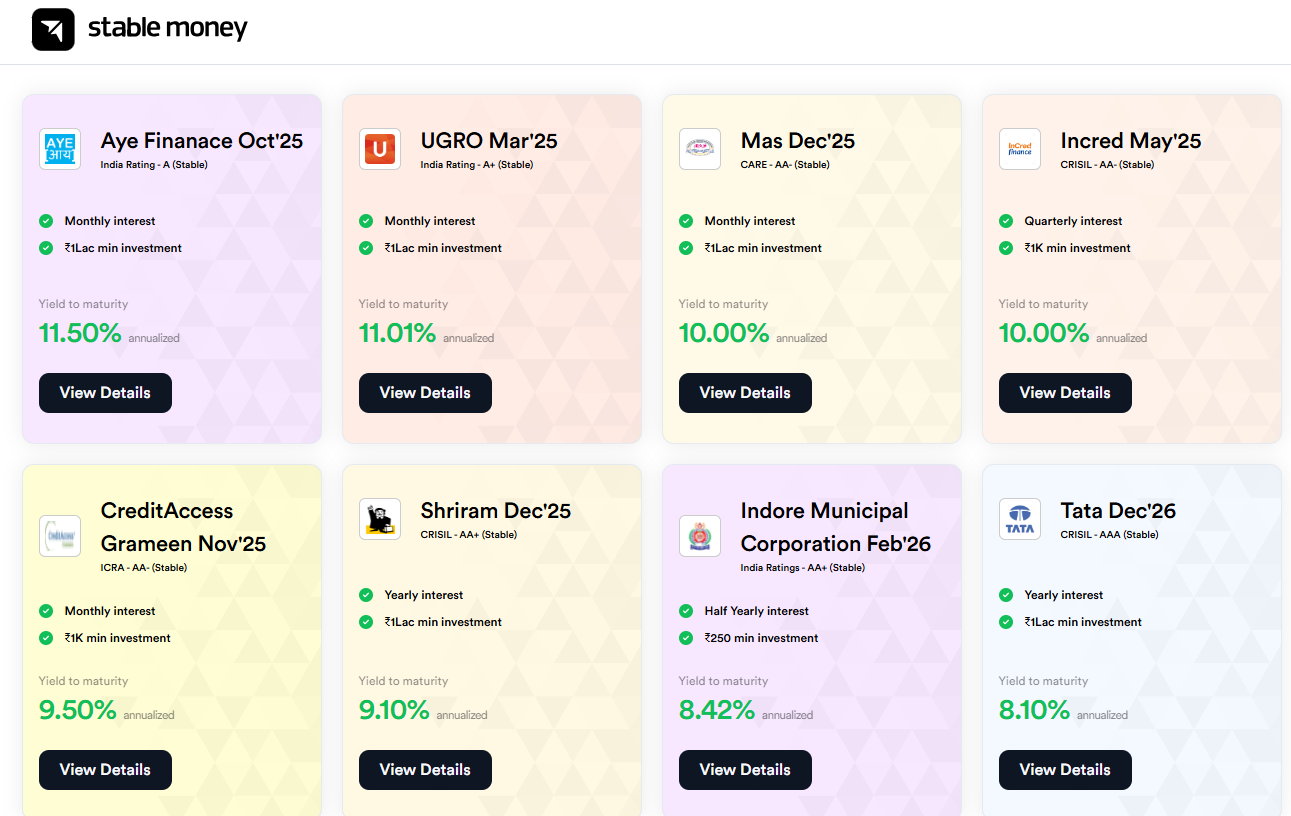

Investing in Bonds with StableMoney: A Smart Choice for Steady Returns

Investing in Bonds with StableMoney: A Smart Choice for Steady Returns

-

The Importance of Multiple Streams of Income for Financial Independence

The Importance of Multiple Streams of Income for Financial Independence