-

Mutual Fund Inflows in India: SIP Trends and Top Contributing States

India’s mutual fund (MF) industry has seen a remarkable surge in inflows, making it an attractive avenue for those on the Financial Independence, Retire Early (FIRE) journey. Investors are increasingly turning to Systematic Investment Plans (SIPs) as their preferred investment strategy, contributing to record-breaking inflows. This post dives into recent trends in mutual fund inflows,…

-

Best Countries for Low Income Tax.

Comparison for a $100,000 Salary: Top 10 Countries, India, and Dubai When it comes to building wealth and reaching financial independence, understanding how much income tax you’ll owe can make a huge difference in your planning. Let’s explore income tax rates for a $100,000 annual income across some key countries, including India, and highlight Dubai’s…

-

Should You Stop SIP in a Bear Market? Why Staying Invested Could Be Your Best Move

If you’re following the principles of financial independence and the “retire early” mindset, you know that consistency is key to building wealth. But when the market takes a downturn, the temptation to pause your Systematic Investment Plan (SIP) can be strong. While it might seem logical to avoid losses in a bear market, continuing your…

-

Dhanteras 2024: Smart Gold Investments – Exploring Gold ETFs for Financial Growth

As Dhanteras approaches on Tuesday, 29th Oct 2024, many look forward to investing in gold for prosperity. With growing interest in digital finance and cost-effective alternatives, Gold ETFs (Exchange-Traded Funds) have emerged as a modern and convenient choice for gold investments. Unlike traditional forms of gold, such as jewelry or bars, Gold ETFs offer advantages…

-

10 Common Telephone Scams in India: Beware and Stay Safe

Scammers are finding new ways to trick unsuspecting people every day, with middle-aged and elderly individuals often targeted. Here’s a rundown of the most common phone scams in India, how they operate, and how to protect yourself. Stay alert and be prepared to identify these schemes before they affect you! 1. TRAI Phone Scam 2.…

-

Cybercrime:Safeguard Your Financial Future: How to Avoid Financial Fraud and Report Issues

As we become more reliant on online financial services, the risk of falling victim to financial fraud is on the rise. Cybercriminals constantly devise new ways to steal our hard-earned money, and without proper vigilance, anyone can become a victim. This guide outlines

-

Mutual Fund: Regular vs. Direct: Why You Should Consider Switching

When investing in mutual funds, you’re often presented with two options: Regular plans and Direct plans. Both offer the same portfolio and fund management, but the cost structures are different. Understanding these differences is essential if you want to maximize your savings and grow your wealth faster, especially if you’re on the path to financial…

-

From India How to Buy U.S. Stocks(Apple, Microsoft, and Google) via Franklin Templeton, Motilal Oswal, and Other Options

Investing in U.S. stocks from India has never been easier. It allows you to diversify your portfolio by gaining exposure to leading global companies, especially tech giants. In this blog, we explore options like Franklin Templeton, Motilal Oswal, and other ways to invest in U.S. equities. 1. Franklin U.S. Opportunities Fund The Franklin U.S. Opportunities…

-

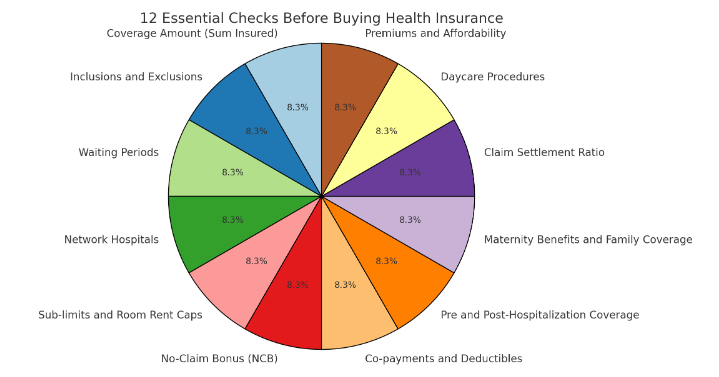

Checklist/A Smart Guide to Buying Health Insurance: What to Check Before You Buy

When it comes to financial planning, health insurance is one of the most critical components, especially for those aiming for financial independence and early retirement (FIRE). Unexpected medical expenses can derail even the most solid financial plans. With the myriad of health insurance options available today, it’s crucial to choose the right policy that meets…

-

How Inflation Eats into Your Savings Over 3 Years: The Fixed Deposit Example

Imagine you have ₹10,00,000 in a Fixed Deposit (FD) earning an annual interest rate of 6%. At first glance, this seems like a reasonable return, but let’s see how inflation impacts the real value of your savings over three years. We’ll assume the annual inflation rate is 7%. Here’s what happens over the next three…

AI Assistant