-

Why SIP is the Best Habit to Start in Your 30s — Even with a Modest Income

Your first salary. You get it in your mid or late 20s, and it feels like freedom. For the first time, you’re not just spending someone else’s money—you’re spending your own. You buy that phone you’ve always wanted, treat your friends to coffee, maybe plan a weekend trip. Life feels good. But here’s something no…

-

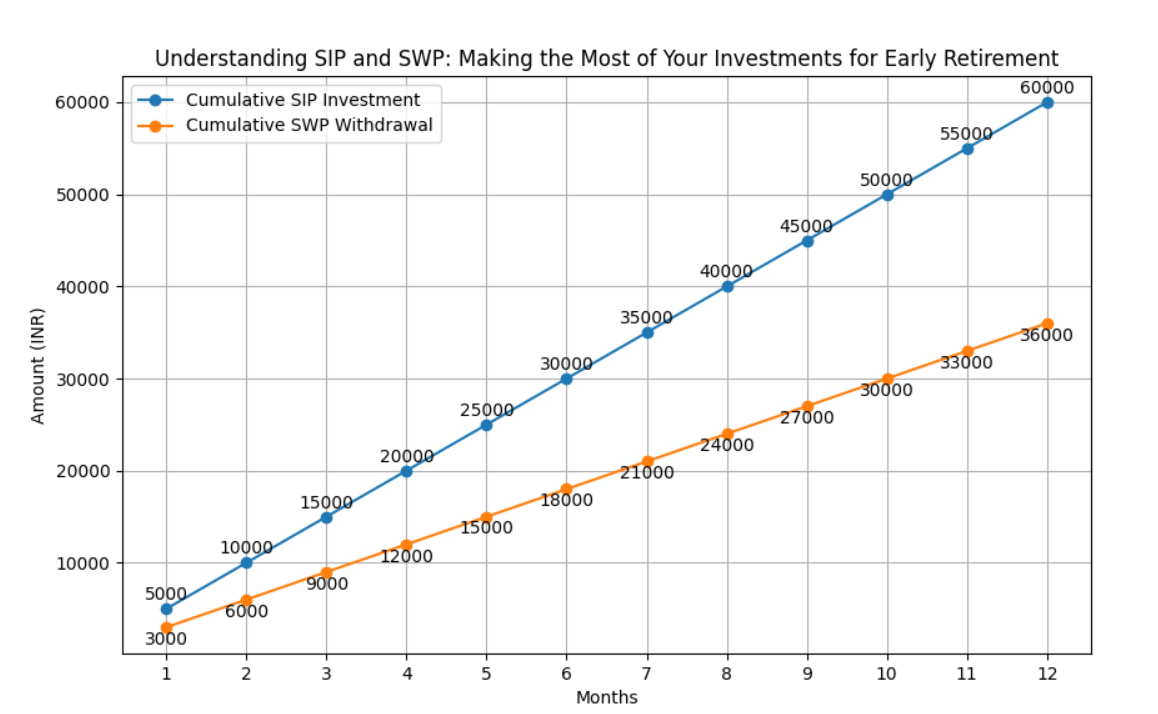

Understanding SIP and SWP: How to Make the Most of Your Investments for Early Retirement

Introduction to SIP and SWP: Your Path to Financial Freedom Achieving financial independence and retiring early (FIRE) is a dream for many, and it requires a well-structured approach to savings and investments. For those on this journey, Systematic Investment Plans (SIP) and Systematic Withdrawal Plans (SWP) can play a crucial role. These tools not only…

-

Should You Stop SIP in a Bear Market? Why Staying Invested Could Be Your Best Move

If you’re following the principles of financial independence and the “retire early” mindset, you know that consistency is key to building wealth. But when the market takes a downturn, the temptation to pause your Systematic Investment Plan (SIP) can be strong. While it might seem logical to avoid losses in a bear market, continuing your…

AI Assistant